Tesla Insurance: Everything You Need To Know

In the wake of several high-profile Tesla accidents, many people are wondering if Tesla insurance is worth the investment. Here’s everything you need to know about insuring your Tesla.

Table of Contents

What is Tesla insurance

Tesla insurance is a new type of insurance specifically designed for Tesla vehicles. It is an insurance product that has been created in response to the unique needs of Tesla owners, and it offers a number of advantages over traditional insurance products.

Tesla insurance is designed to provide comprehensive coverage for your Tesla vehicle. It includes protection against physical damage, liability, and theft. Tesla insurance also provides coverage for any damage that may be caused by electric charging equipment.

Tesla insurance is a great option for anyone who owns a Tesla vehicle. It is an affordable way to protect your investment, and it offers peace of mind in knowing that you are covered in the event of an accident or theft.

How much does Tesla insurance cost

Tesla insurance costs an average of $1,800 per year, which is significantly higher than the average cost of auto insurance. The high cost of Tesla insurance is due to the high cost of repairs and the high risk of liability. Tesla insurance is essential for owners of these vehicles, as it protects them from financial loss in the event of an accident.

What is the best Tesla insurance

There is no one definitive answer to the question of what is the best Tesla insurance. However, there are some key factors to consider when choosing an insurance policy for your Tesla. Some important things to look at include the coverage options offered, the cost of the policy, and the company’s reputation.

When it comes to coverage, you’ll want to make sure that your policy covers all of the bases. This includes liability coverage in case you are responsible for damages or injuries caused to others, as well as collision and comprehensive coverage in case your Tesla is damaged in an accident. You may also want to consider adding additional coverage options such as roadside assistance or rental car reimbursement.

The cost of your insurance policy is also an important consideration. You’ll want to get quotes from several different companies before making a decision. Be sure to compare not only the price of the policy, but also the coverage options and deductibles.

Finally, you’ll want to research the reputation of any insurance company you’re considering doing business with. Checking online reviews and ratings can give you a good idea of what other customers have experienced. The Better Business Bureau is also a good resource for information on companies.

Who offers Tesla insurance

There are many insurance companies that offer Tesla insurance. Some of the more popular ones are Geico, Allstate, and State Farm. There are also many smaller insurance companies that offer Tesla insurance.

Why do I need Tesla insurance

As a Tesla owner, you need to ensure that your vehicle is properly protected in case of an accident or other unforeseen incident. Tesla insurance provides coverage for repairs or replacements should something happen to your car. It also gives you peace of mind knowing that you and your family are protected financially in the event of an accident.

What coverages are included in Tesla insurance

When it comes to insurance for your Tesla, there are a few key coverages you’ll want to make sure you have in place. Here’s a rundown of the most important coverages to consider when insuring your Tesla:

-Liability coverage: This will protect you in the event that you’re found responsible for damages or injuries caused in an accident.

-Collision coverage: This will help pay for repairs if your Tesla is damaged in an accident.

-Comprehensive coverage: This will cover damages caused by events other than accidents, such as weather damage or theft.

-Uninsured/underinsured motorist coverage: This will protect you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

Making sure you have the right coverages in place will give you peace of mind behind the wheel of your Tesla.

How does Tesla insurance work

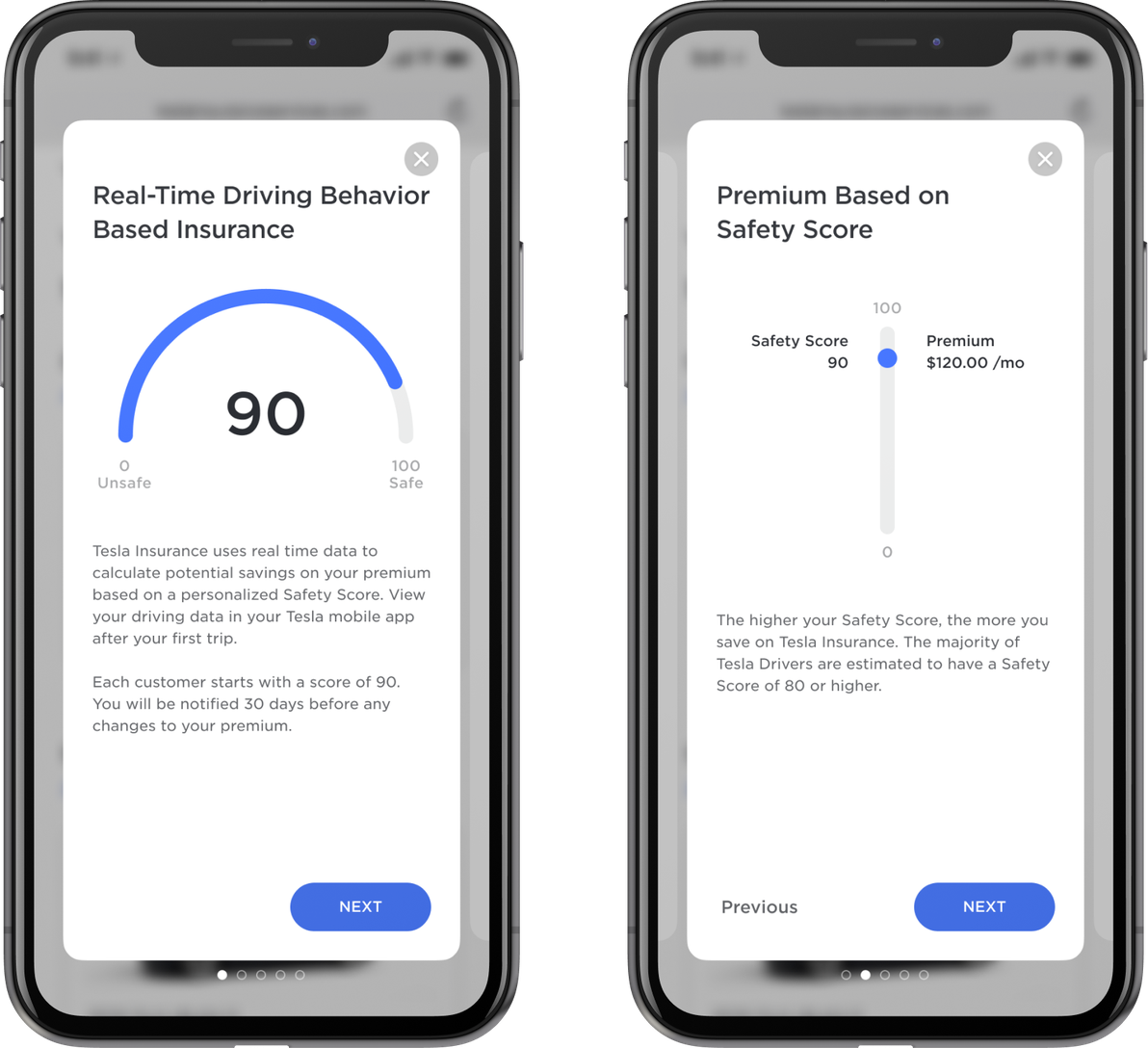

Tesla insurance works by using a variety of data to help calculate rates. This includes things like the car’s safety features, repair costs, and the driving habits of Tesla owners. The company also offers a variety of discounts, including ones for good drivers and those who have multiple Tesla vehicles.

What are the benefits of Tesla insurance

There are many benefits of Tesla insurance. One benefit is that you will be able to get your Tesla repaired or replaced if it is ever damaged in an accident. Another benefit is that you will be covered if your Tesla is ever stolen. Finally, Tesla insurance can give you peace of mind knowing that you and your Tesla are protected.

Is Tesla insurance worth it

Tesla insurance is worth it if you own a Tesla. If you don’t own a Tesla, then you probably don’t need Tesla insurance.

How can I get a quote for Tesla insurance

There are a few things you need to do in order to get a quote for Tesla insurance. The first is to find an insurance company that offers Tesla insurance. Then, you will need to get a quote from that company. Finally, you will need to compare the quotes from different companies in order to get the best deal on Tesla insurance.